Share this article

Table of Contents

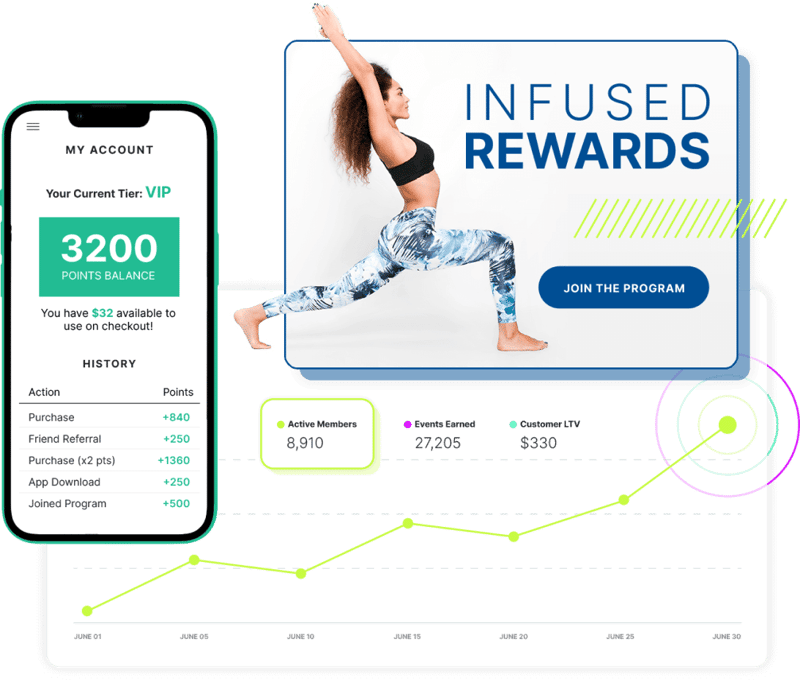

There are many types of loyalty programs that are great for expanding revenue and reducing customer churn. “Top-performing loyalty programs can boost revenue from customers who redeem points by 15 to 25 percent annually,” notes McKinsey, highlighting one of the top reasons brands flock to them. Simply put, loyalty programs boost the bottom line.

But notice that key phrase: top-performing. Not all loyalty programs are made alike. If you want to unlock the kind of value McKinsey is talking about, you’ll have to fit your brand and your niche to the appropriate loyalty program. The best way to do that is to learn the types of loyalty programs that might work for your business.

And the right loyalty program software makes that easy to do.

Types Of Loyalty Rewards Programs

From a bird’s-eye view, every loyalty program is generally the same thing. Your company is offering some sort of incentive in exchange for the customer’s continued business. And in this context, that loyalty comes with bottom-line tangibility: you want to see your most loyal customers continue to buy from you.

But zoom in and you’ll see that the way you dole out these loyalty rewards is critical. Just as you wouldn’t pet a cat backward, you shouldn’t expect any loyalty program to work if it rubs customers the wrong way. Your loyalty program only works if it’s what your customers want. For example:

- Do they want to rack up points because they make repeat purchases? This is similar to the “buy ten burgers, get one free” card many of us are familiar with. If you sell consumable items, there’s a good chance your business will overlap with a points-based loyalty program.

- Do they want to feel like a VIP? This works very well for upscale brands with higher-value, higher-margin products on sale.

- Do customers want exclusives, or to unlock more advanced prizes? If you find yourself in the middle of the two options above, then newly-released products and exclusive offers for your most loyal customers might work.

Each of these styles has its upsides and its downsides. Let’s dive into the specific solutions for your offerings to get a sense of which best align with your brand.

Learn more: New to Loyalty Marketing? Start Here

Points-based loyalty programs

Point-based loyalty programs offer simple incentives for every purchase a customer makes. For example, if a customer spends $50 on your website, you might promise 50 points toward your loyalty rewards program. How you divvy up these points is up to you, but every points-based loyalty program will work on this same basic premise.

Consider the example of a coffee shop. Starbucks has a robust loyalty program with a simple idea: one point for one dollar spent. Because coffee is something most consumers will repeatedly buy (admit it: every day), people are happy to sign up for it. That money is going towards coffee anyway, they figure. If it can add up to long-term loyalty benefits, that’s icing on the cake.

Another example, outside of coffee, is the Chipotle rewards program. Like Starbucks, Chipotle offers a consumable product that disappears as soon as it ends up in the consumer’s hands. Creating points-based loyalty rewards that live beyond the meal help extend the customer’s incentives to return to the restaurant.

Chipotle’s reward program is slightly different because it offers 10 points for every dollar spent. But how much value each point redeems is ultimately up to the company creating the loyalty program.

You can also use this style of rewards program with higher-ticket items. If you sell furniture, for example, you can create a points-based loyalty program. People don’t buy furniture as often as they do coffee, but furniture is another item people need.

Same with nail products. Friendbuy customer Olive & June uses a points-based rewards loyalty program to keep customers coming back when they do need to top up or replace their existing products.

.jpg?width=800&height=452&name=oliveandjune%20earn%20loyalty%20points%20(1).jpg)

Luxury brands that don’t necessarily sell what people need might tend to stay away from points-based loyalty programs. With those brands, cultivating a sense of VIP exclusivity is more appropriate. It’s the day-in, day-out reinforcement of loyalty at which points-based programs excel.

When to use points-based programs: If your brand has repeatable purchases, point-based loyalty programs are usually appropriate. Adding points to every purchase might not feel like much incentive. But if a customer occasionally redeems those points for your rewards, they’re going to remember that. And they’re likely going to give their regular business to you.

Pros

- Ideal for customers who “are going to buy the product anyway”

- Don’t require expensive incentives, as long as the points add up

- Help promote brand loyalty by having a customer log in to check their balance

- Reinforces brand loyalty by offering tangible benefits on constant, repeated purchases

Cons

- Might lose effectiveness if people buy your items less often, or for occasional luxury “splurges”

- Might only be somewhat reinforcing, depending on the level of points you dole out

Tiered loyalty programs

Unlike the static approach of points-based loyalty programs, tiered loyalty programs acknowledge that a customer might not always want to return the next day. Or even the next month. But how do you incentivize customers when they don’t necessarily want to throw repeat business your way in the first place?

The solution is to promise a pot of gold at the end of the rainbow. A tiered loyalty program doesn’t just promise rewards they can redeem right now. It also promises the possibility that if they continue buying from your brand, they can unlock rewards at a higher rate.

.png?width=645&height=535&name=nuuly%20tiered%20loyalty%20program%20(1).png)

This example from Nuuly shows a tiered rewards package in action. Rather than offering 1:1 rewards for customer referrals, they draw customers back with higher rewards as they unlock higher tiers.

Think of this as “gamification.” One of the ways mobile apps keep us so addicted is to consistently give us new, higher levels of rewards to shoot for. We’re unlocking achievements and expanding our capacity. Every time we want to put the phone down, we have to fight the urge that the next great reward is just…around…the corner.

It can work the same way with tiered loyalty programs. In the Nuuly example, you see this strategy playing out with a refer-a-friend program. By offering tiered rewards, Nuuly adds more incentive for customers to go out and evangelize their brand. A customer who might have only thought of one friend for a referral suddenly has to think about the other friends they can contact.

If you struggle with repeat business, a tiered loyalty program gives customers the sense that they’ve “leveled up” with your brand. And it forces them to continue to purchase from you if they haven’t leveled up yet. The benefit is that you create a loyalty program with more long-term “pull.” There’s something for customers to work towards.

The risk of a tiered loyalty program is that it can get too easy to unlock these rewards, potentially costing a lot of money. Loyalty programs are great for business, but every brand has to consider what it’s willing to spend to encourage customer loyalty. A well-performing tiered loyalty program may force you to ask: how much is a loyal customer worth to your bottom line?

When to use this: When you rely less on regular, smaller payments and subscription-style services and need to keep customers coming back for long-term reasons. Clothing brands, for example, might perform better with tiered loyalty rewards programs than a coffee subscription service.

Pros

- Potentially inspires customers to return who otherwise wouldn’t have thought about engaging

- The promise of future higher tiers can potentially inspire more sign-ups

- Great for brands who don’t offer small items that customers can buy frequently

Cons

- The higher-priced incentives can be more expensive on your end

- There is potential for customers to drop out before unlocking the tiers

- You’ll have to experiment a little to find the right balance between incentivizing tiers and your loyalty program budget

Paid loyalty programs

When in doubt, create a direct customer incentive. In other words, you can directly give customers a lump prize (like a gift card, for example) for signing up for your loyalty program.

.png?width=400&height=625&name=smile%20club%20paid%20loyalty%20programs%20(1).png)

Here’s an example of a direct incentive from Smile Direct Club’s referral program. See how straightforward it is? $100 in a gift card that the customer can use at the store. But it also explicitly states what the gift card is for, reinforcing the link between what the customer did and the reward they’re receiving.

Paid loyalty programs work the same way. You might opt to pay your customers a sign-up gift card, for example, just to enroll them. Companies do this because they know the value of customers in a loyalty program is much higher than in customers who are on their first visit.

After all, you’re fighting against emerging customer trends. One study found that 55% of customers no longer trust the companies they buy from, at least not as much as they used to. The Internet has made all sorts of new brand options available to customers. It’s also made it harder to tell which brand is out for genuine customer relationships and which is in it for a quick buck via digital marketing.

The result: a lot of skeptical customers. That includes customers who might have even purchased from you once before.

Sometimes, no amount of trust-building with a growing brand is going to convince people to trust you more than the Amazons and Walmarts of the world. You may need to give a jolt to the system. That’s where paid loyalty programs help.

But what do we mean when we say “paid” loyalty programs? And just what are you paying for, anyway? There are several different approaches you can take:

- Paying people to sign up. This one is a great way to build trust and participation in your loyalty program, but it also carries a big risk: that people will sign up and never use your loyalty program again. Generally, you want to reward people on the back end with your paid loyalty programs. This ensures you’ll get the higher participation and larger order sizes you were hoping for.

- Paying out gift cards. If customers find your brand reinforcing enough, you can let your customers redeem gift cards when they’ve made enough purchases through your loyalty program. Think of the “buy ten subs, get one free” model. Because that credit still goes toward your business, it’s much easier to manage. And because redemption requires your brand’s presence, it’s also more reinforcing.

- Paying out generalized gift cards. If you don’t have that kind of brand loyalty yet, don’t fret. You’ll likely find you can build paid loyalty incentives that still match what customers want to see. However, you may have to offer gift cards from other companies. Think of this as borrowing the trust and credibility already built by those larger brands. Customers may be happy to work through your loyalty program with the promise of that gift card at the end.

Not sure what that last point looks like? Here’s an example where Casper used a $200 Amazon Gift Card, high above its standard referral reward of $75, to give an instant boost to a seasonal campaign.

.png?width=600&height=352&name=casper%20paid%20loyalty%20programs%20(1).png)

There are a few things happening here. First, the “limited time” message creates scarcity. Right off the bat, customers know that this isn’t an offer they’ll see last all year long. This provides additional incentive to try out the referral program.

Second, Casper recognizes that not everyone might need a mattress. But customers might know someone who needs a mattress. By issuing an Amazon Gift Card for a referral, it’s giving out a prize that just about anyone can use.

The key here is to dial into what it is your customers are thinking. Use surveys and feedback from your customer service team to dig deep. What do your customers most value? What most incentivizes them? Until you do this work, you might be surprised at how difficult it can be to even pay customers to join a loyalty program.

But when you do find out what customers want, you can dial in your paid loyalty program as appropriate. And you’ll likely notice an uptick in participation, redemption rate, and the average order value of anyone using the program.

When to use this: Any time your loyalty rewards program needs a shot in the arm, a paid reward can do exactly that. You’ll likely find that it works great for referral programs, as well. If you sell high-ticket items like Caspar mattresses, your customers may need a little extra incentive to continue to buy from you, as they don’t always have to return to a store like yours every month. A paid loyalty program can keep your business at the tops of their minds.

Pros

- If you align your incentives with customer needs, it can deliver an instant uptick in loyal customers

- Can potentially cause your customers to share your loyalty program with friends

- Helps businesses who sell more expensive items to retain more of their customers and sell accessories

Cons

- Can be expensive or can eat into the average order value when you issue gift cards

- May sometimes require you issuing gift cards and incentives that go through other brands

- Your brand will need to structure it properly to ensure customers don’t sign up for the reward and quickly disappear

Value-based loyalty programs

Hopefully, any loyalty program you build is going to be valuable. But “value” in this context doesn’t refer to the value you offer your customers. Tiered loyalty programs and paid loyalty programs offer plenty of it. The values we’re talking about here refer to what customers most value in the world, which often overlaps with charitable donations, sustainable business practices, and making a demonstrable impact on the world.

In other words, these loyalty programs are for those customers who don’t want a quick Amazon gift card, or redemption points toward their next purchase with you. They want to see that their money is going to a company that not only values its customers, but values its place in the world.

One report showed that 83% of millennials, for example, want companies to align with their values. And they may be willing to change their purchasing habits to focus on brands that do. About 65% of millennials reported that they boycotted a brand they’d previously purchased from because of a misalignment in those values.

The key here, however, is building trust. And the next generation, Gen Z, is notoriously wary of what companies say they do. As McKinsey notes, about 88% of Gen Zers say they don’t trust what brands claim about their ESG (environment, social, and governance) programs.

That means if you want to build a value-based loyalty program, you have to align two things:

- Your value incentives. Are the value incentives you use in your loyalty program, such as donating to a charity on behalf of the loyal customer, appropriate for your market? This is where surveys, feedback, and talking to your customer support team have to come into play. Discover the key value triggers that get customers in your market to pay attention.

- Your brand’s credibility. Consider building visual testimonials about the real-world impact of the values-based rewards you offer. Seek out stories. Create a web page that highlights key statistics, like the total dollars donated through your program. The more you can do to establish that there is a real impact from using your loyalty program, the more likely it is that younger customers will trust you enough to sign up.

Look around and you’ll see brands that merge their values with their business. Zambeezi lip balm, for example, donates proceeds to its home country of Zambia. Conscious Step is a sock brand that offers a wide variety of charities for donation. Prosperity Candle supports female refugees coming to the U.S. Tom’s Shoes donates ⅓ of proceeds of profits to charitable causes.

When to use this: When you work in a market sector that’s most likely to be motivated by loyalty incentives that make an impact. Or whenever you want to make an impact. Value-based loyalty programs are just as effective for your brand as other types of programs on this list; you’re merely changing who receives the proceeds when a customer redeems their “prize.”

Pros

- You can “put your money where your mouth is” when it comes to charitable donations

- Many young consumers like to find brands that align with them on core values

- These charitable prizes can go to good causes, which benefits everyone

Cons

- Some customers might not find charitable donations to be as incentivizing

- It may take some time before you find a charitable donation that aligns with your customers’ wants

- You may have to spend some extra time double-checking the quality of the charities you select

Subscription-based loyalty programs

Sometimes, you might ask customers to pay you. It sounds counterintuitive, but if you provide enough value, this can tie customers more tightly to your brand than you might imagine.

In a subscription-based loyalty program, a customer pays a monthly or yearly fee to gain access to wider benefits within your store. You may not even offer special “loyalty points,” but simply open up VIP-style premium offers that they wouldn’t otherwise have available. A classic example of a subscription-based loyalty program is Amazon Prime. Customers have to pay for two-day shipping and other benefits, like Amazon’s Prime streaming service. The program is worth paying for on its own. But customers who receive free shipping may turn to Amazon more in the future, knowing that every purchase they order through Amazon’s free shipping services will tip the scales in their favor.

.jpg?width=1870&height=627&name=amazon%20prime%20(1).jpg)

That’s the power of a subscription service. While it might sound like it’s asking a lot of your customers to sign up for a “premium” experience, many are happy to. They only ask that the value you provide in return makes it more than worth their while. And as they sign up for your subscription-based loyalty program, they’re more incentivized to keep buying from you. After all, they want to get their money’s worth.

When to use this: If you have enough value to offer, and you want your customers “locked in” to your store, this is an ideal way to build loyalty.

Pros

- Customers feel invested in your brand and frequently turn to it for purchases

- Customers will pay you for the right to enjoy the loyalty program

Cons

- Do you offer enough value? If not, it may take some time and money before you can justify charging a subscription

- It may require upfront investing until you see the long-term rewards in the total volume of subscribers

Choosing the Right Loyalty Rewards Program for Your Business

There’s no doubt about it: a great loyalty program can inspire the kind of long-term engagement any business needs. But you may not have the success you’re after until you choose the right kind of loyalty program for your customers. Learn what they value most. Learn what incentivizes them. Learn what makes them tick. When you do, the style of loyalty program you choose will feel all the more engaging.

Follow these loyalty program best practices to really fine tune your program for maximum return. And take a look at the loyalty program examples for some inspiration.

Interested in learning how you can build one of these loyalty programs with your company? Contact Friendbuy sales today to find out how you can get your loyalty program to fit your brand’s ambitions.